Products pitched as healthier, higher-quality are in demand, and the trend is fueling deals like Haier’s acquisition of a GE unit. From spirits distillers and dairy producers to cafes, the latest mouthful in corporate buzzwords that market to the aspirations of China’s 1.4 billion consumers is “premiumization.”

As China’s economic slowdown impedes the expansion of household spending, companies such as Kweichow Moutai Co., Danone SA and Starbucks Corp. are positioning to attract the rare segments that are poised to grow rapidly—products touted as healthier, higher-quality and fancier than the basics.

“Chinese consumers are making purchase decisions based on how products make them feel,” said Vishal Bali, managing director of consultancy Nielsen China. “With increasing affluence, consumers are craving products that offer an enhanced, premium experience.”

Visitors at the 2016 Beijing Auto Show. Photographer: Fred Dufour/AFP via Getty Images

The demand for premium goods—typically about 20 percent pricier than the average in the same category—is gaining traction as an increasing number of Chinese families cross the income threshold to become affluent. For Chinese mainland households, being rich means earning 136,000 yuan ($19,800) or more annually, according to Gavekal Dragonomics.

About 11 million Chinese households are crossing to become affluent each year. How the newly-flush Chinese are being drawn up-market is highlighted in the following charts that track their consumption:

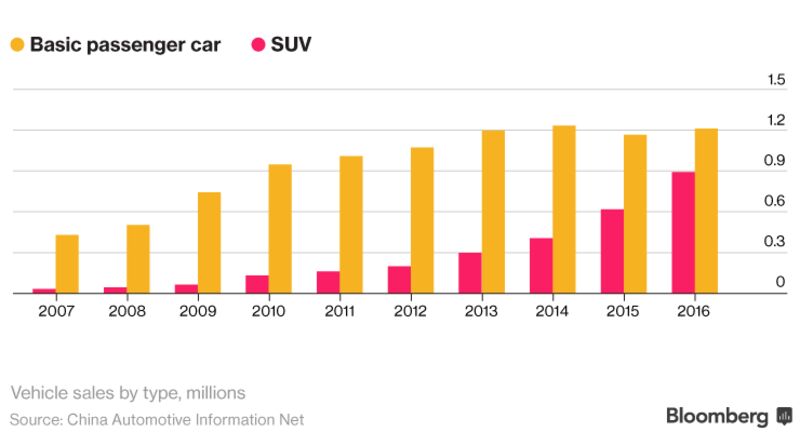

Sales of SUV Accelerate as Cheaper Cars Slow

SUV and minivan sales are expected to outstrip sedans this year for the first time. Rising incomes, cheaper oil and Chinese government policies allowing more children are triggering a fundamental shift in the world’s biggest car market. That’s prompted Great Wall Motor Co. and Zhejiang Geely Holding Group to introduce upscale brands offering spacious models with the latest technologies. Though the SUVs are at least 40 percent more expensive than sedans, said Gavekal, sales of SUVs are expected to gain 22 percent this year.

Bigger and flashier is often the ride of choice, as 56 percent of Chinese consumers say one motivation for buying premium products is to show off their success, according to research firm Nielsen. The Chinese penchant for showing off is above the Asia Pacific average of 52 percent, and far higher than the 21 percent in Japan and 24 percent in Australia.

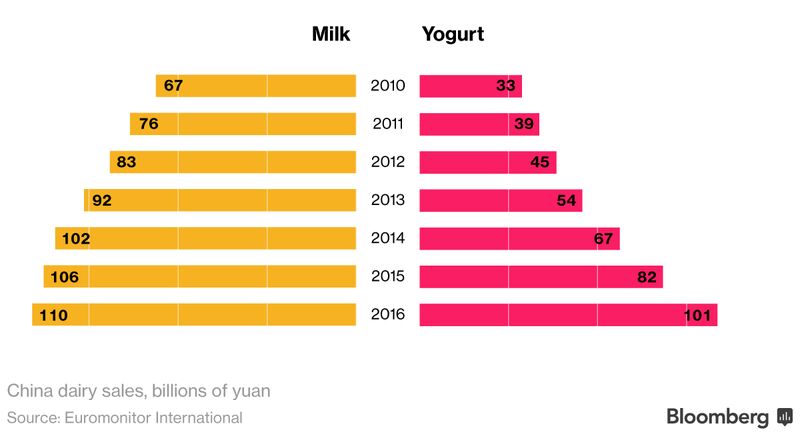

Yogurt is Fast Catching Up to Milk

Health-conscious and wealthy Chinese consumers have raised their spending on a range of product categories marketed at improving the quality of life. Fifty percent or more of shoppers say they are forking out more money for groceries, clothing, entertainment, travel and dining out, according to the Nielsen Feb. 7 report, which surveyed 30,000 people worldwide.

Yogurt demand is surging due to its perceived health benefits over liquid milk, according to OC&C Strategy Consultant. “The first, basic wave is milk, now it’s going to yogurt, and usually the next phase is cheese,” Greater China partner Jack Chuang said.

A delivery rider carries empty water bottles on his tricycle in Beijing. Photographer: Greg Baker/AFP via Getty Images

That trend has spurred Chinese companies to scoop up makers of premium products, including acquisitions in recent months by China’s top two dairy producers, China Mengniu Dairy Co. and Inner Mongolia Yili Industrial Group Co.

Deal interest is also coming from private equity investors. Hong Kong-based PAG Asia Capital said this month it would pump $170 million into Latvian dairy maker Food Union Group, with plans to bring its products into China, citing “a great demand among increasingly affluent and discerning Chinese consumers for high quality protein foods,” according to a statement.

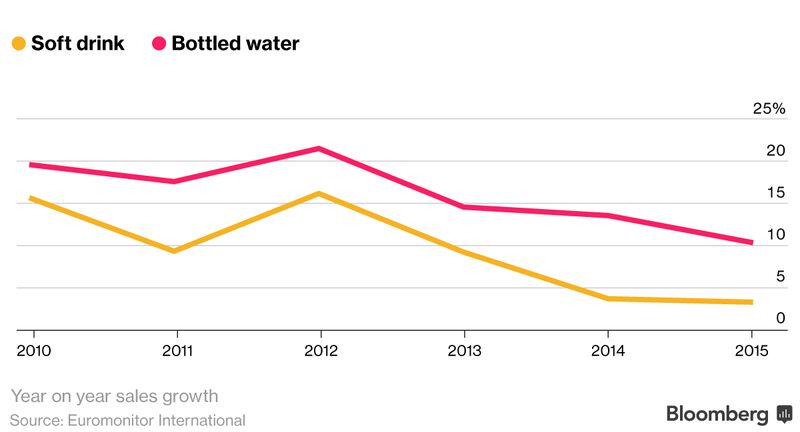

Bottled Water Still Growing Three Times the Pace of Soft Drinks

Rising obesity rates are leading to increased awareness among consumers who are turning away from sugary drinks. Consumers prefer drinks specially designed for their kids, according to a Mintel Group Ltd report on 2017 consumer trends in China.

That hurts traditional soft drink makers such as Coca-Cola Co. and PepsiCo Inc. in the long-term, as growth in sales of bottled water outpaces fizzy beverages. Coke President James Quincey said the company is positioning itself though different brands to sell higher-end bottled water to Chinese customers.

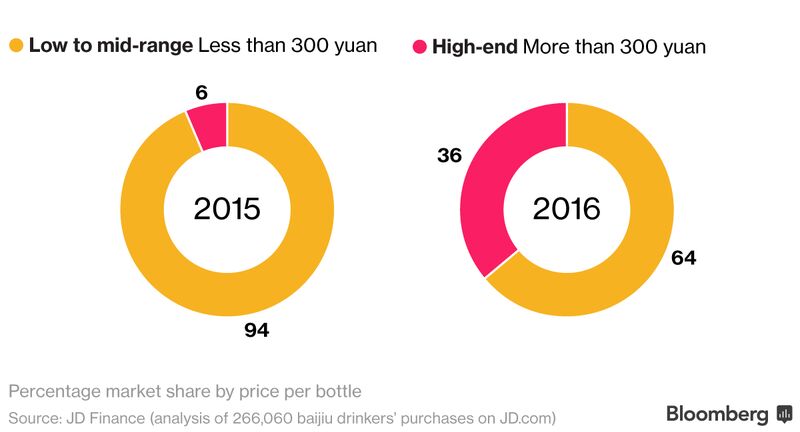

The upgrading trend is also evident in the demand for the Chinese fiery liquor known as baijiu. Mid-range drinkers are increasingly trading up to more expensive bottles costing more than 300 yuan ($44) a pop, according to JD Finance, the data unit of e-commerce retailer JD.com.

Baijiu Drinkers Are Shifting Towards Pricier Bottles

Top-shelf baijiu brands such as those made by Kweichow Moutai, Wuliangye Yibin Co. and Diageo Plc’s Shuijingfang can cost about 800 yuan per bottle. JD Finance’s tracked the purchases of 266,000 users since 2015 it identified as regular buyers of mid-price baijiu.

The consumption shift extends to beer, with imports of foreign, premium labels surging 340 percent in the past four years as affluent drinkers trade up. That’s in contrast to the demand for lager from China’s local brewers, including Tsingtao Brewery Co. and China Resources Beer Holdings Co., which makes the popular Snow brew. They’ve seen revenue stagnate as the overall beer market declines in volume.

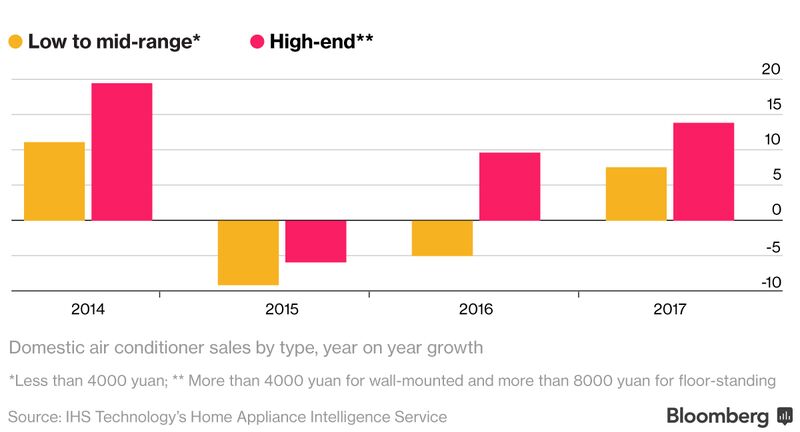

High-End Air Conditioners to Remain Ahead After Slump in Sales

In Chinese homes, most urban families have already stocked up on basic appliances such as air-conditioners and microwave ovens. Shoppers are now upgrading to products that are typically viewed as indulgences, such as espresso machines. And when it’s time to replace basic white goods, they’re upgrading to fancier versions that make less noise and are connected and controlled through apps.

That trend is behind deals like Haier Group’s $5.4 billion acquisition of General Electric Co.’s appliances unit last year so it can offer Internet-connected products ranging from ovens to washers.

“China’s home-appliance makers are focusing on implementing a high-price strategy instead of relying on large volumes,” said IHS Markit Technology principal analyst Horse Liu. “They are going from being driven by production capacity to being driven by innovation.”

Credits: Rachel Chang

No comments:

Post a Comment